Amazon has one of the most complicated fee structures known to mankind. It’s as if they want the question “What does it cost to sell on Amazon?” to be completely unanswerable. But you need the answer to turn a profit!

To determine the real cost of selling on Amazon, we’re going to have to dive in deep. It’ll get complex. If you’re just looking for a quick overview, check out our quick guide in “How to Sell on Amazon for Beginners” or see SupplySpy's awesome infographic on Amazon seller fees.

Still with me? Awesome! Grab a cup of coffee and buckle in.

We’ll start by identifying your costs per sale. Later, we’ll tally them up and set a price that will absorb all of your Amazon fees. Finally, we’ll walk through a sample cost calculation together.

Last updated 8/5/2020.

Selling Plan Fees

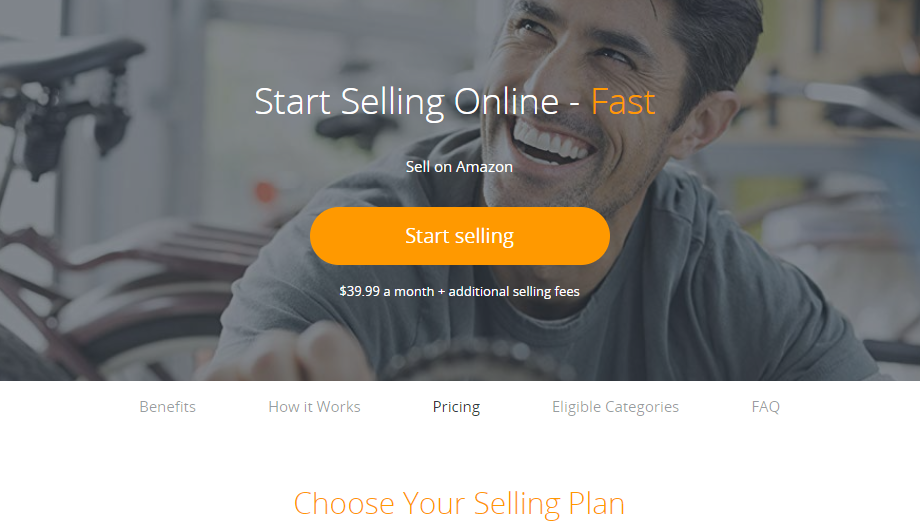

Amazon offers two different selling plans: Individual and Professional.

Sellers who choose Individual have no monthly fees for their account, but must pay $0.99 for every sale.

Professional sellers get to skip that fixed fee in exchange for paying $39.99 a month. It’s therefore clearly the best choice for anyone who makes at least 41 sales per month.

You may want to count your Professional selling plan fees in your costs to make sure they get completely covered. If so, just divide the Professional fee by your average sales per month.

Example: Say you make 100 sales per month. 39.99 / 100 = 0.40 after rounding up, so that’s an extra $0.40 you have to incorporate into your costs per sale.

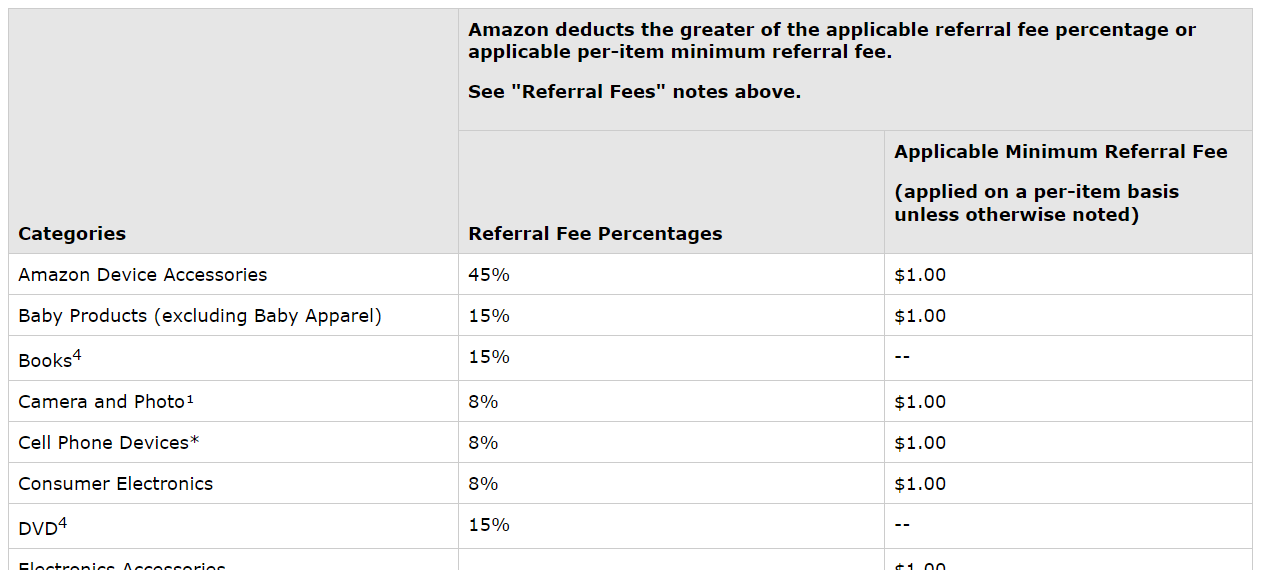

Referral Fees

Amazon charges referral fees on every item sold. In most categories (including Books, Home & Garden, Office Products, and Sports), this fee is 15%, though it can be much lower or much higher.

The referral fee is determined based on the total sales price charged to the customer. Gift wrapping charges, shipping and handling, you name it, it all counts toward the amount Amazon will use to calculate the referral fee.

Thankfully, there is one exception. The referral fee will not be applied to taxes charged using an Amazon tax calculation service.

Example: Say you're selling a book and charge a customer $15 for the book itself, $4 for shipping, $3 for gift wrapping and $1 in sales tax. Amazon ignores the $1 from sales tax and calculates the referral fee based on a total sales price of $22. So, your 15% referral fee would come out to $3.30.

Note that if you’re selling something for a low price, you may end up having to pay the minimum per-item referral fee rather than the percentage. The minimum referral fee is $0.30. Some categories and subcategories are exempt from this kind of minimum fee.

Closing Fees

Amazon’s variable closing fee, or VCF, used to be one of their most bewildering charges, with incomplete and often contradictory statements scattered across their website. Luckily, they've mostly straightened it out (with a few old references to the variable closing fee still scattered across the site), and now they have the much simpler closing fee.

As of August 2020, the following product categories have a $1.80 closing fee for sellers in the US:

- Books

- DVD

- Music

- Software & Computer/Video Games

- Video

- Video Game Consoles

- Video Game Accessories

If you sell items in categories not listed above, you don’t have to pay a closing fee. It's that easy.

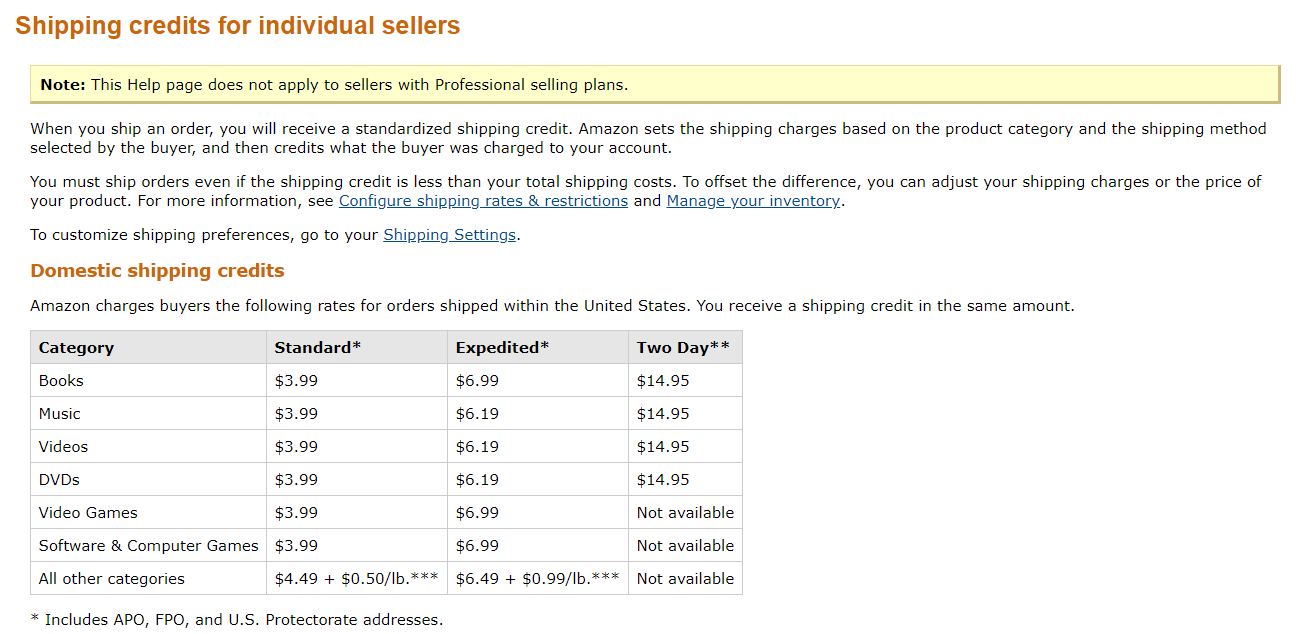

Shipping and Handling

Amazon usually lets you set your own shipping and handling rates.

If you’re an Individual seller, Amazon sets shipping rates by default. You can find the amount Amazon will charge to the customer for shipping and handling in "Shipping credits for individual sellers." Amazon will then pass this payment on to you.

However, the amount they set is often much lower than what you’d actually have to pay to ship the item. Never assume Amazon shipping credits will cover your shipping expenses.

You can usually raise your shipping rates if necessary. Just be warned that you can't do this to a customer who has already made a purchase—once an order is placed, you have to deliver, even if it means losing money!

Note that for Individual sellers, shipping rates are totally fixed for products in the Books, Music, Videos, DVDs, Video Games, and Software and Computer Games categories. You're also locked into weight-based shipping for all other items, with no regard for other factors that may raise the cost of shipping, like the size of the item.

If you're an Individual seller, I strongly recommend you read our article on determining shipping and handling costs. This will help you find out how much your shipping and handling will run you. Then you can subtract your shipping credit from your actual shipping and handling expenses and increase the price of your item accordingly.

Of course, when you increase your item price, your fees go up. So you'll still lose money if you only increase your price by the difference between shipping cost and shipping credit.

Warning: Punching your computer will not help you determine how much it will cost to sell on Amazon.

But don't worry: we have an algorithm for that! We'll get to it later. For now, you just want to know the difference.

Example: Say you have a $3.99 shipping credit. The actual cost of shipping and handling the item is $4.99. You should then account for $1.00 of extra expenses when calculating the sale price of your item.

Even Professional sellers normally have Amazon's default BMVD (Book, Movie, Video, and DVD) shipping rates in place. Fortunately, Professional sellers can now set their own BMVD rates.

You might think you don't have to worry about shipping costs if you use FBA. Not true. FBA sellers have to ship their items to an Amazon Fulfillment Center, so even though Amazon will take care of shipping the item to the buyer, you still have shipping and handling costs. Take the time to determine what those costs are so you can cover them in your item’s price.

FBA sellers should also note that they can get discounted shipping through Amazon Partnered Carriers.

Fulfillment by Amazon Fees

If you use Fulfillment by Amazon, you will have to pay a series of fees. These are variable and cumulative. For example, you must pay a monthly storage fee for each item, and this rate is higher during the holiday season (October through December) than the rest of the year.

FBA fees may change from time to time as well. For example, in 2020, fee changes occurred on February 18. It’s therefore important that you get the rates directly from the horse’s mouth. You can find current FBA rates here.

In order to calculate the full cost of selling on Amazon as an FBA seller, you’ll need to estimate how long each of your items is going to stay in storage. Then use that estimate—plus the weight and dimensions of your product—to determine your average FBA fees per sale.

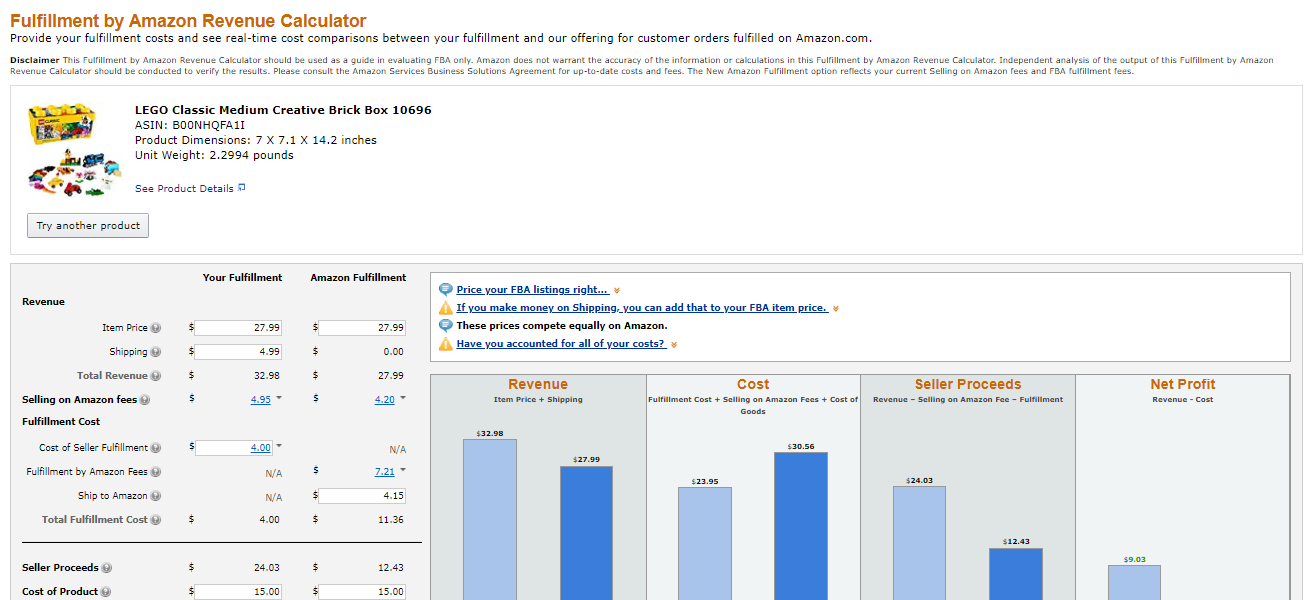

Luckily, the FBA Revenue Calculator can make determining your fees per item easy.

Bank Fees

Since Amazon deposits your payments directly into your bank account by default, you should get the full amount of each sale after you’ve paid their fees.

Some banks, however, may charge you a flat fee per transaction. This is particularly common if you’re having the money transferred to you across international borders. To make sure you incorporate this cost if it applies to you, you’ll need to divide the transaction fee by your average number of sales per Amazon pay period.

Example: Say you make an average of 100 sales per month and Amazon deposits your payments into your bank account on a monthly basis. Additionally, your bank charges a $45 flat fee per deposit. 45 / 100 = 0.45, so that’s an extra $0.45 you have to incorporate into your costs per sale.

Are There Any Costs I Don’t Have to Worry About?

If you have sales tax processing set up, then sales tax will be charged to customers after all the other fees are calculated. They won’t affect your per-transaction expenses.

Amazon also absorbs payment processing fees charged by credit cards and the like. One less thing to worry about (finally)! But before you get too comfortable, be warned that they generally will not cover chargebacks.

Advanced Amazon Fee and Expense Calculation

With multiple flat and percentage fees to deal with, how can anyone hope to set a price that will cover all their expenses and get exactly the profit they want? It turns out it’s not too hard to do—all you need is a little algebra. Specifically:

x – [(y*x) + z] = p.

First, figure out how much you want to receive from customers. This amount needs to cover:

- Your shipping and handling expenses

- The cost of buying or manufacturing the item you’re selling

- Your desired profit

We’ll use this value as “p.”

Next, add up your fixed fees per transaction. These may include:

- Your selling plan fee ($0.99 if you’re using an Individual plan, or your Professional selling plan fees divided by your average sales per month)

- A referral fee (if you’re charging a low enough price to need to pay the minimum)

- A closing fee

- FBA fees

- Bank fees, if any (calculated as the cost per Amazon deposit divided by your average number of sales per pay period)

This value will be “z.”

Next, if your referral fee will be charged as a percentage, then enter this percentage as a decimal for “y.” For example, if you have a 15% referral fee, then you would enter 0.15. If you aren’t getting charged any percentages, enter 0.

Finally, the amount you want to charge to customers to get your desired profit will be “x.” This will be the total you charge for the item and shipping combined.

Enter the values you’ve come up with and solve for “x” to find out how much to charge to completely absorb the cost of selling on Amazon. Here’s the formula again:

x – [(y*x) + z] = p.

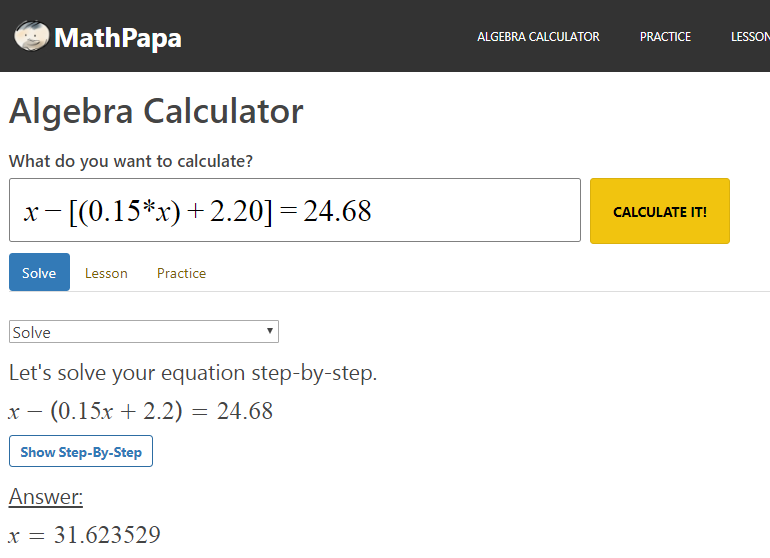

You don’t actually need to know how to do algebra to solve this—you can just plug it into an algebra calculator like Math Papa to get the answer.

Example: Calculating How Much It Will Cost to Sell on Amazon

Let’s say I’m an Amazon seller with a Professional plan who is not using FBA. My item is a set of three books weighing in at 2 pounds 14 ounces.

Determine “P”

First, I determine that I can ship these books via USPS Media Mail to just about anywhere in the US for $3.68. I also estimate I’ll spend $1.00 on packaging. That’s $4.68 in total shipping costs.

I already know that sourcing these books costs me $10 per set. All told, that’s $14.68 in expenses I have to cover just to break even.

Next, I set my desired profit. If I can’t take home more than $10 per sale before taxes, I don’t want to sell these books.

In order to get those $10 in profits and cover my grand total of $14.68 in expenses, I’ll need to receive $24.68 after fees. I’ll therefore enter 24.68 as “p” in the formula.

Determine “Z”

Now it’s time to add up my fixed fees.

Since I’m using a Professional selling plan and I average 100 sales per month, my fees average out to $0.40 per sale.

Since I’m selling books, my closing fee is $1.80. Books have no minimum referral fee for me to worry about, so I’ll calculate the referral fee as a percentage in the next step.

I have no FBA fees, since I’m handling my own fulfillment.

Looks like my fixed fees total $2.20. Not too bad! I’ll enter 2.20 as “z.”

Determine “Y”

The referral fee for books is 15%. I therefore enter 0.15 as “y.”

Solve for “X”

The formula I get is this: x – [(0.15*x) + 2.20] = 24.68. I plug that into Math Papa and get $31.62 as the amount I need to charge my customer for the item and shipping combined.

Proof It Works

Using the answer I got above, I set my prices.

Since I'm a professional seller, I can set my own BMVD shipping rates. I charge my actual shipping costs of $4.68 for standard shipping on my set of three books (my actual costs).

To bring the total up to $31.62, I then charge $26.94 for the books themselves. My customer pays my needed total of $31.62 for the books, plus any applicable sales tax.

While the sales tax goes to the government, Amazon and I start splitting up the rest.

Amazon charges me 15% of $31.62 as the referral fee: $4.74. I also lose $1.80 to the closing fee and $0.40 to my Professional plan fees. So my Amazon fees total $6.94.

I also spend $4.68 on shipping, and already spent $10 purchasing the set of books.

All told, that’s $21.62 of expenses on my $31.62 sale. My profits are therefore $10—exactly what I was aiming for.

Conclusion: What Does It Cost to Sell on Amazon in Reality?

The real cost of selling on Amazon consists of the following:

- The costs of manufacturing or purchasing the item.

- The costs of packaging, handling, and shipping the item—whether directly to the customer or to an Amazon Fulfillment Center.

- All per-transaction Amazon fees.

- Any related overhead (selling plan fees, storage fees, transaction fees, etc.) averaged out over each payment period.

In addition to these costs, you may have other setup costs and overhead: fees for government permits, payments to freelancers or employees, and the value of your own labor. Always ensure your profit margins are large enough to account for these expenses.

We cut our own expenses dramatically by connecting Amazon to a helpdesk. It makes a huge difference, especially if you sell on other platforms like eBay and connect those as well.

Had enough math for one day and looking for something more exciting? Discover what to sell on Amazon and start making money! If you already know what to sell, read up on how to get a great Amazon seller rating to keep the customers rolling in.