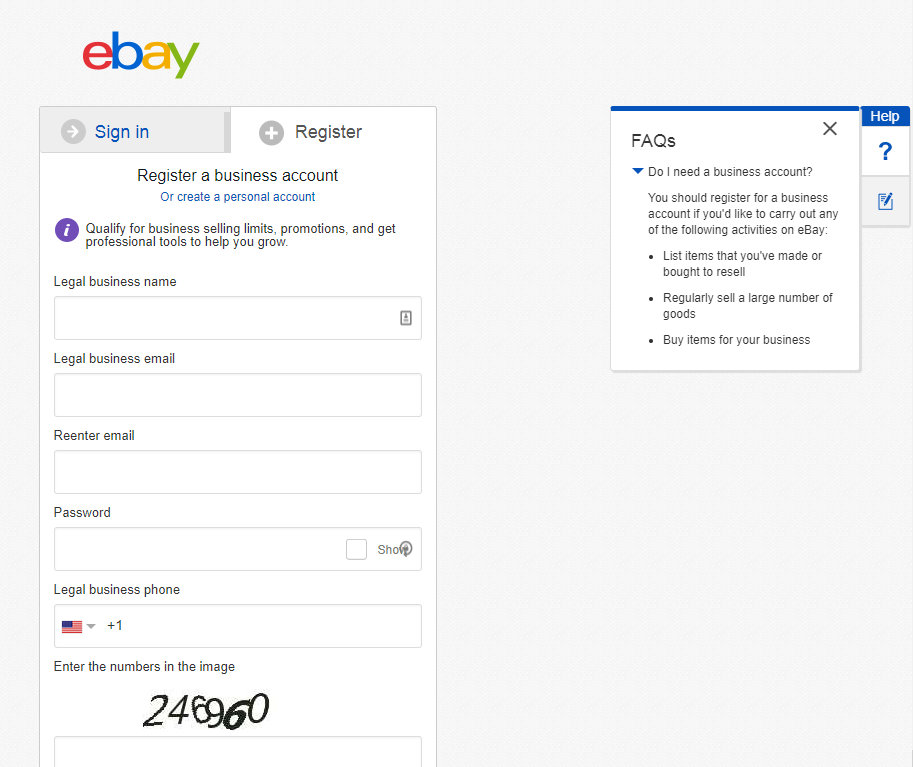

On the eBay registration screen, there's a tempting little link suggesting that you create a business account. The most common response is to stare at the screen in confusion. First-time sellers rarely know if they need an eBay business account, let alone what the pros and cons are.

Here are the reasons for and against choosing an eBay business account:

Last updated 4/3/2020.

Cons

“Business” is just another name for “work,” and you’ll have yours cut out for you if you choose a business account.

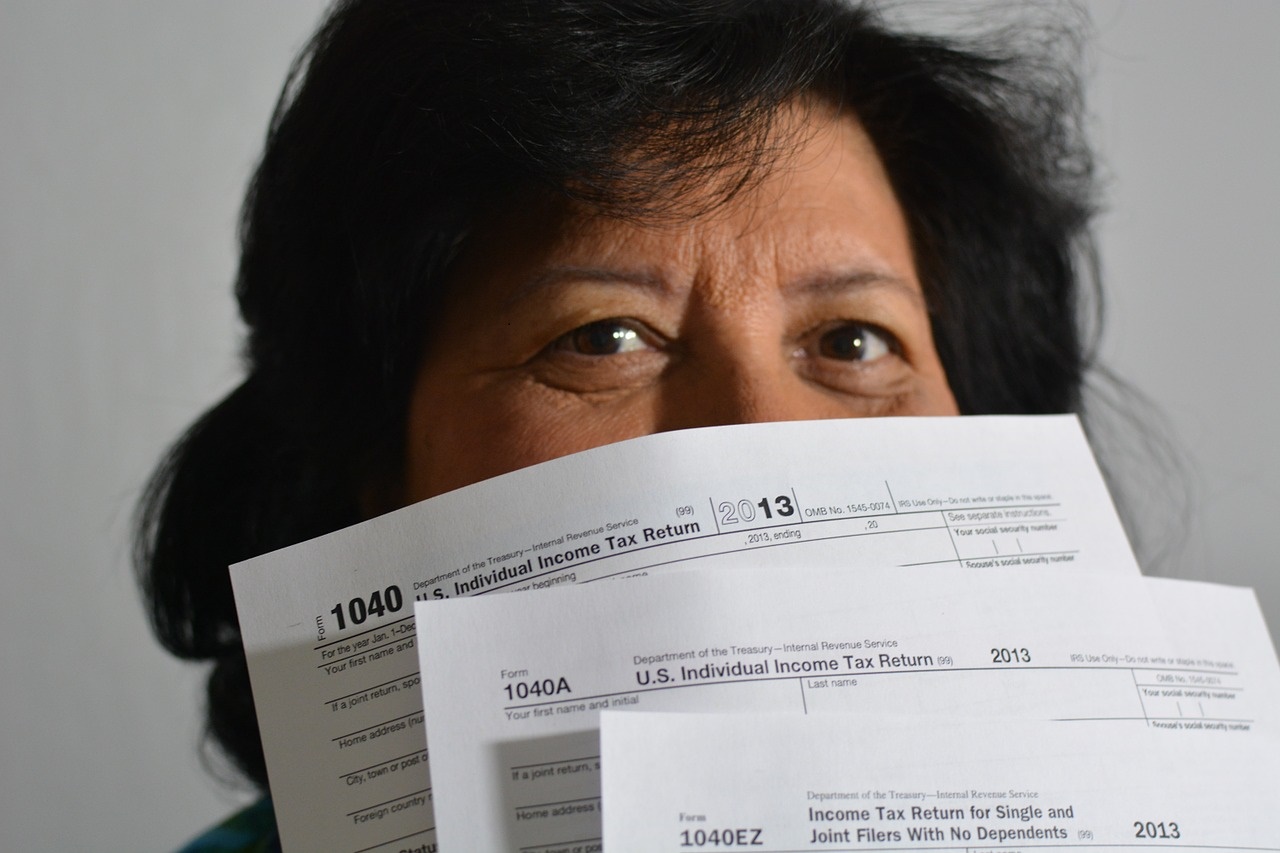

1. Complicated Taxes

If you register as a business, you will have to handle your eBay income as business income. This will probably double the work you do on taxes every year.

2. More Paperwork

You will need to keep detailed records of every transaction to prepare for tax season. This doesn’t just mean your eBay sales, but purchases of things you plan to sell on eBay, gas money and mileage while you’re on the job, etc. as well.

Pros

Registering a business account can help keep you in the good graces of your country’s tax agency and save you a lot of money. Plus, eBay lists a few good reasons to go for it on their registration page, as pictured on the left below.

1. Higher Selling Limits

eBay places selling limits on new sellers, which can be as strict as a maximum of 10 items per month when you first open an individual account. Using a business account will get you access to higher selling limits so you can actually do business!

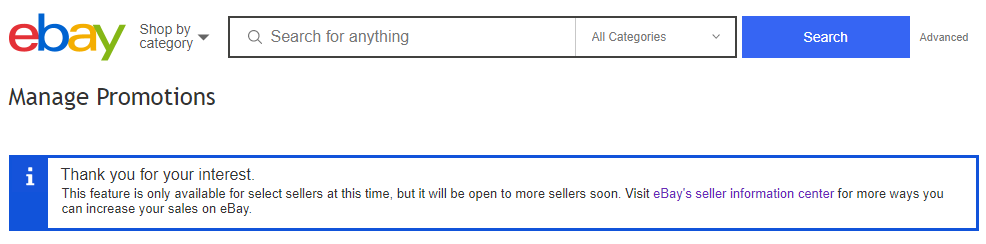

2. Access to Better Tools & Promotions

eBay is pretty cryptic about what exactly these tools and promotions you're getting are. But, there are quite a few tools and features on eBay that are restricted to a limited number of sellers, like Promotions Manager. Here's what happens if you try accessing Promotions Manager with an average individual account:

It's safe to say that business accounts are more likely to have access to features like this. There's no guarantee you'll be able to use them the moment you switch to business, though.

3. Lower Taxes

Although businesses have to pay additional taxes on top of those that individuals pay, they have far more opportunities for deductions. Some sellers have saved five figures a year* just by switching from individual to business taxes and making good use of deductions. Just be sure to do your homework—Uncle Sam doesn’t always go out of his way to share all the ways you can pay less on your taxes.

*Source: "An Independent Tax Specialist's Advice for eBay Sellers" on eBay. The article was lost when eBay removed their community chatter pages.

4. The Ability to Use Your Company Name

It’s a bit of a tragedy to go through all the trouble of registering a business name only to be unable to use it on eBay. On top of that, you may be legally required to do business under a registered name if you have one. Choosing a business account allows you to use your company name on all communications with buyers.

5. Legal Protection

The last thing you want is for taxes to go sideways when an auditor sees you used an individual account for both personal and business transactions. The results could be bad. If you have a registered business, it’s better to dot your i's, cross your t's, and sleep easy knowing that all your business transactions are on a clearly labeled business account.

6. Greater Selling Privileges in Crisis Situations

We're updating this article at the height of the COVID-19 pandemic to mention that eBay has temporarily restricted certain items to business sellers only. For example, if you don't have a business account, you can't sell toilet paper. Read "What eBay Sellers Can Expect during the Coronavirus Pandemic" for details.

Do I Need to Choose a Business Account?

If you’re just selling your old stuff and buying things for personal use, an individual account should be fine. But a business account is essential if you’re using eBay for, well, business. Selling things you’ve purchased or made strictly for the purpose of selling generally counts.

Make sure you’re legally registered as a business if you aren’t simply running a sole proprietorship under your own name.

I’ve Registered as a Business. How Can I Make This Less Work?

Your taxes won’t be fun, I’ll give you that. But now you can use your ability to deduct eBay business expenses to make life a lot easier!

Services and software used only for your online selling business will almost certainly be tax-deductible. That means you can take advantage of eBay customer service software, contracted labor, multichannel software for eBay and Amazon, and all sorts of other powerful time-saving options that were too expensive to use before.

Running your eBay operation as a business can look like a lot more work and expense at first and then turn out to be a lot less. The cons of an eBay business account may be inevitable, but use the pros to your advantage and you’ll be glad you took the leap!

Need more help with the tax challenges of running an eBay business in the US? See “A Quick Guide to Online Sales Tax.”