Gift-giving is a wonderful tradition in theory. But in practice, it can lead to a lot of disappointment and cluttered closets. Selling unwanted gifts on eBay can help with both those problems.

eBay is easy to use once you know what you’re doing. The first time, though, you can expect to run into mountains of tough questions. Do I have to pay tax? Collect tax? What about fees? How does shipping work?

Here are answers to those questions and more, plus some tips on getting started:

Disclaimer: This article includes our interpretation of tax law, and although based on experience and research, it may be inaccurate. We are not tax, financial, or legal professionals. You are responsible for your own understanding of, and compliance with, the law.

Last updated 7/25/2018.

Do I Have to Pay Any Fees?

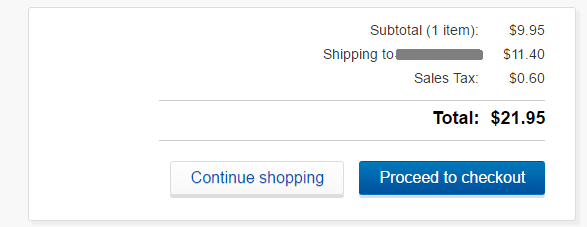

Yes—you must pay fees on every successful sale. Expect to pay 12.9% of the total sale amount plus $0.30 between eBay fees and PayPal processing. Note that the 12.9% applies to what you charge for the item AND whatever you charge for shipping.

For more details, see “Does It Cost Money to Sell on eBay?”

How Does Shipping and Handling Work?

When you create the listing for your item, eBay will recommend a shipping option that provides a great combo of speed and value. You can leave it as is or change it before the listing goes live.

Whatever you decide, make sure you have easy access to the courier to keep shipping simple, affordable and fast. Don’t pay surcharges for pickup or drive across the state to use UPS if FedEx is five minutes away!

eBay also provides an estimate of your shipping costs. This makes it easy to decide how much to charge for shipping. With that said, you might want to incorporate those costs into your item price and offer “free shipping” instead of charging for it separately.

For a great guide to getting the supplies you’ll need, safely packing your item, and determining shipping costs, see this page on eBay.

Tax Requirements for Selling Unwanted Gifts on eBay

The last thing anyone wants to do is make their taxes more complicated. Do you have to collect or pay any taxes on resold gifts?

We are not tax professionals, but here’s our understanding:

Income Tax

Short version: sell it for less than the giver paid and you shouldn’t have to pay income tax.

According to TurboTax, Americans do not have to pay income tax if they get no more for reselling a gift than the giver paid for it. That makes things easy!

If the giver paid $49.99 for a gift and you sold it on eBay for $45 (after subtracting what you paid for shipping and fees), you should be able to pocket the money without sparing Uncle Sam a second thought.

Be aware that it’s what the giver paid for the item that matters and not the item’s value. If the item was 20% off and they only paid $40, then you would have to report the extra $5 you made as profit.

Do your best to find out how much the giver paid. You can try calling their favorite store or checking their preferred shopping website, or if you really want to play it safe, asking someone who went shopping with them in strict confidence.

Sales Tax

Short version: your state/city may not require taxes on occasional sales; if it does require them, you may be responsible for collecting sales tax.

If you don’t run a business, you probably won’t have to worry about sales tax. But it’s a good idea to make sure first!

Avalara has a great discussion on how sales tax applies to selling personal items. Many states provide an occasional sales tax exemption, allowing individuals who don’t sell for profit to sell a couple unwanted gifts on eBay every year without paying any sales tax. A few, like New Hampshire, have no sales tax at all.

However, some states—and possibly some cities—require you to collect tax on all taxable sales. And you generally must get a sales tax permit in order to collect the tax. That permit often comes with a fee of its own.

If your state and/or city requires you to collect sales tax, check what sales would be taxable. As we discuss in our article on online sales tax, you generally only have to collect sales tax if you sell to someone in a place where you have a “physical nexus”—a physical location for your selling operation. (This may be changing due to the Supreme Court's decision on South Dakota v. Wayfair, but the new rules shouldn't affect personal sales.)

If everything you plan to sell will stay in your home until you ship it to the buyer, your home is probably your only nexus. So that means you should only have to worry about sales tax if you sell to someone in your state. And even then, you don't need to bother if your state and city have either no sales tax or an exemption for occasional sales.

Whew! Back to easier questions.

Do I Choose a Business Account or Personal Account?

If you just want to sell unwanted gifts, go with a personal account. You only need a business account if you plan on selling for profit. eBay Business Account Pros and Cons has more details.

Should I Choose Auction or Fixed-Price Listing?

If you have no plans to start a selling business this year and don’t want to deal with tax headaches, I would go with fixed price. Income tax complications could arise if the auction does really well and you end up making a taxable profit. Of course, if you have a valuable antique or collectible and could make a load of cash from a successful auction, those headaches might be worth it!

How Do I Get My eBay Listing Noticed?

Most likely, other eBay sellers have already listed the same item you plan to sell. How do you get someone to buy from you when there are dozens of other choices?

Four things will make a huge difference:

- Take lots of great photos.

- Learn how to price on eBay.

- Write a great description.

- Follow eBay’s recommendations for a great title.

Following those steps should be plenty to get your item sold. If you don’t get any bites, though, then see our article on eBay SEO for more advanced tips.

How Do I Go Beyond Selling Unwanted Gifts on eBay?

It’s easy to get addicted after making your first sale! If you want to start building a business, see our articles on eBay business models and selling on eBay for beginners. A year from now, you might go from selling unwanted gifts on eBay to being successfully self-employed!